Stake Ethereum on the best terms

Stake Ethereum on an institutional level platform. We will provide the most favorable, secure and customizable conditions on the market

Non custodial

Secure

Profitable

They staked with us

Stake to maximize profit

Our APR is on average above the market

P2P APR

Market APR

5,6%

5,4%

Top validator performance

100% slashing protection

No missed blocks

Due to backups for each validator component spread across 5 separate European locations and client software diversity (Prysm, Teku, Lighthouse)

We have never been slashed, provide slashing coverage by default for all clients, and slashing insurance if you need it

40% of rewards come from block creation. We guarantee no missed blocks and refund rewards according to our SLA

Stake with minimum risks at all stages

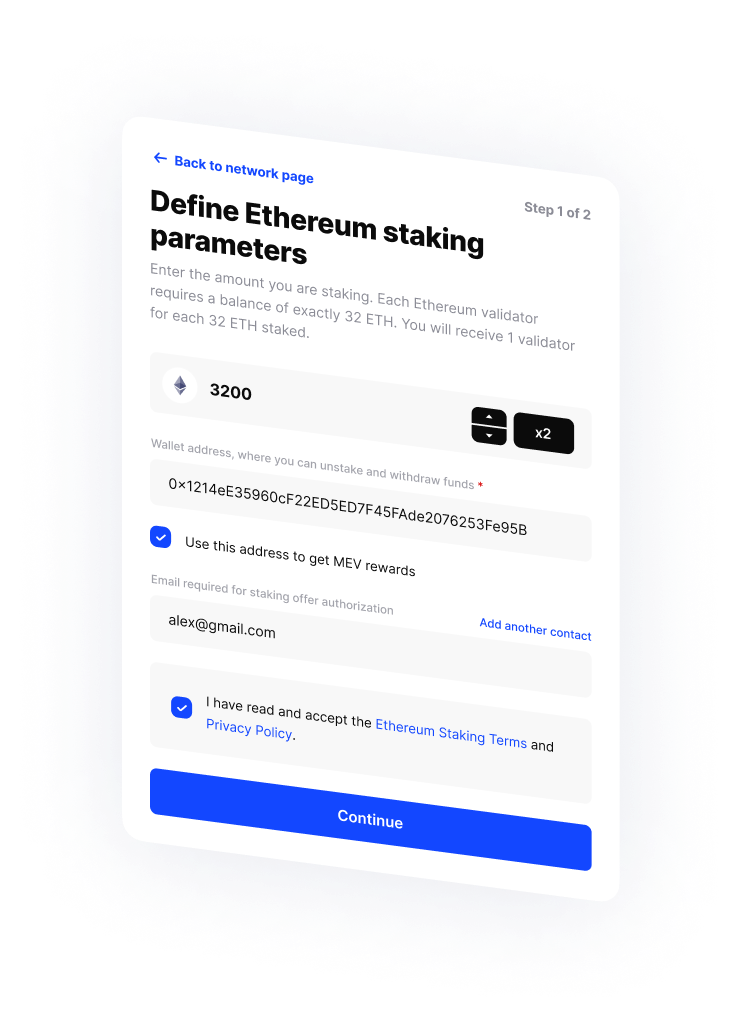

You define staking parameters: addresses for withdrawal and rewards, the staking amount in ETH

P2P run validators with cryptographically protected keys

For Ethereum staking, it is necessary to provide the following:

- address for withdrawal

- address for receiving rewards

- ETH amount to stake

We are launching validators that will participate in securing the Beacon Chain and execute "duties" and get rewarded for this by the new issuance of ETH. The private keys of these validators are protected by advanced cryptography (threshold) so that no one outside or inside our company has access to client ETH

You stake on many validators in one transaction

By design, Ethereum requires one staking transaction per 32 ETH. Our audited depositor smart contract allows you to activate up to 100 validators with a single transaction. This simplifies and reduces the cost of staking and minimizes the risk of human error

P2P maintains validators with top performance

We utilize back-up servers to ensure a 24 hour uptime. These backups include not only validator components but also software client diversity (Prysm, Teku, Lighthouse)

You get rewards for block proposing right away

Rewards for attestations (60%) accumulate in the Beacon Chain smart contract and can be withdrawn after the Shanghai upgrade. Transaction fees (40%) appear with every block created by your validator and are automatically delivered to you through our immutable audited smart contract

1 hour

1 step

2 step

24 hour

time to activation

3 step

100% slashing protection

Default slashing coverage

80% Slashing coverage

100% Slashing coverage

If a slashing event occurs, we cover it from our own fund limited by 12 months of P2P revenue. Free for everyone.

Insurance covers 80% of slashing incidents with a higher limit ($3.5M).

Insurance covers 100% of slashing incidents with no limits.

We have 0 slashing events recorded, 5 technical levels of slashing protection and customized slashing coverage options:

Cost: +5 pp. validator fee

Cost: 1 pp. APR

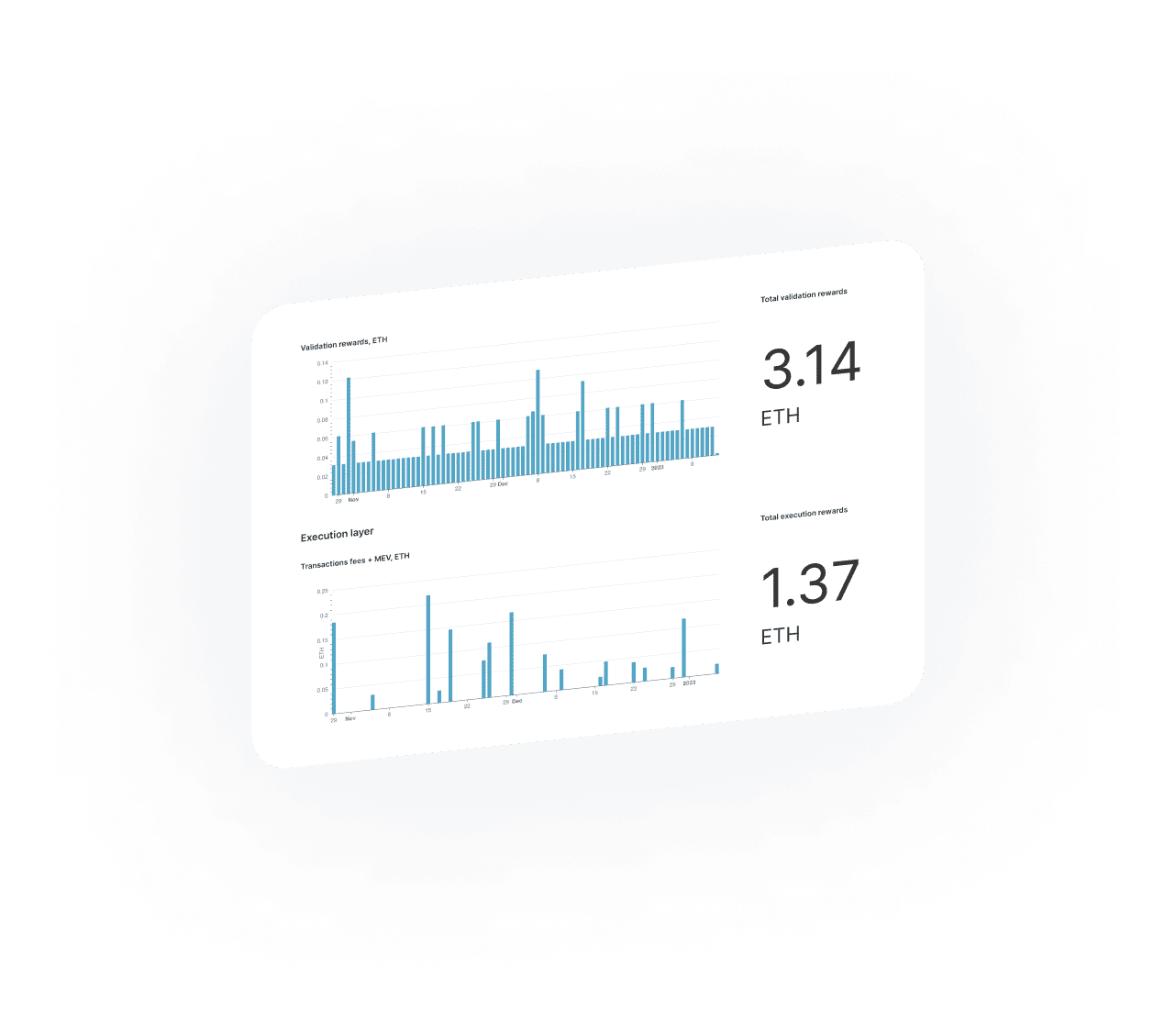

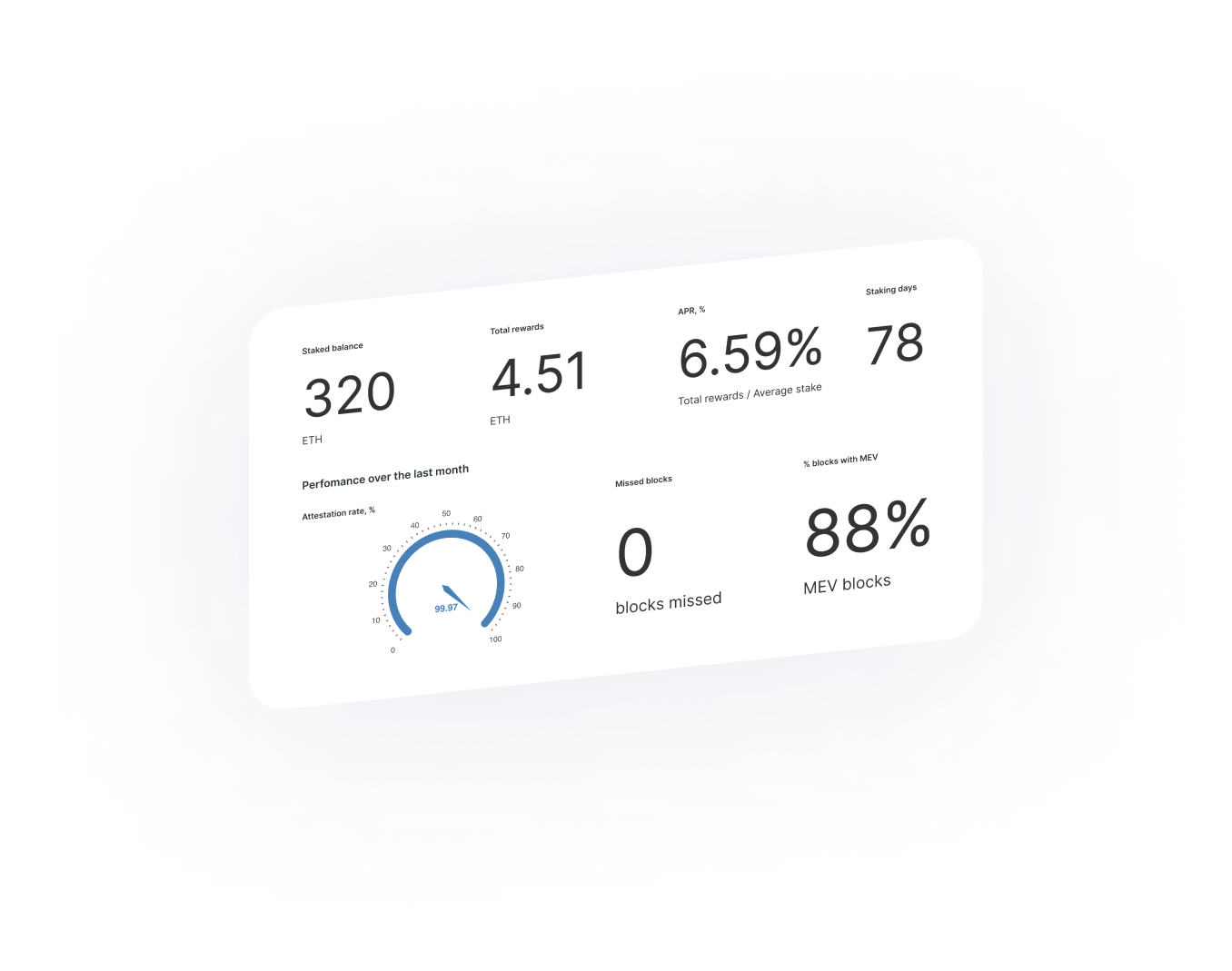

Advanced staking dashboard

You will get a personal advanced staking dashboard for tracking rewards and your validator’s performance.

It contains an overview and deep analysis of your rewards, APR, MEV, attestation rate, missed blocks, comparison with the market etc.

You can explore your validator performance with self-explanatory charts or download raw data in CSV format.

It contains an overview and deep analysis of your rewards, APR, MEV, attestation rate, missed blocks, comparison with the market etc.

You can explore your validator performance with self-explanatory charts or download raw data in CSV format.

Staking guide

Ethereum 2.0 staking — The Beginners Guide

One of the most significant changes that Ethereum is undergoing now is the introduction of Ethereum 2.0, which implies a switch from the Proof-of-Work (PoW) to the Proof-of-Stake (PoS) protocol. This upgrade is aimed...

9 SEPTEMBER 2022

F.A.Q.

What is Ethereum staking?

Ethereum uses “Proof-of-stake” (PoS) as a consensus mechanism, where validator’s responsible for reaching a consensus on adding new transaction blocks to the blockchain. The network rewards validators for honest work or punishes them with penalties for bad performance. Anyone can take part in this consensus mechanism, all you have to do is run a validator (or ask to run it staking-as-a-service provider like P2P.org) and deposit 32 ETH to a special smart-contract to activate your validator. This act is called staking.

No, if you work with P2P, then you do not need to go through KYC because your assets do not get to our account and are sent directly to the Ethereum network

You don’t need any Ethereum to run a node. However, you need to stake 32 ETH x [amount of validators] to activate validators and start getting rewards.

Withdrawal address is your Ethereum address for unstake and receiving rewards. This address is specified once and nobody can change it after the staking deposit is sent, because the network cements the association of a particular validator and withdrawal address. So you must keep access to the private key for this withdrawal address to unstake (seed phrase). Important that P2P is not a custodian and has no exposure to the client’s withdrawal private key. P2P will never ask you, under any circumstance, at any time for the revelation of your withdrawal key.

Validator key is a private key for maintaining the validator’s work (setting up validators, updating software etc.). P2P owns the validator keys and guarantees the highest standards for protecting these keys from being compromised, breached, or otherwise misused. This is accomplished through Threshold signatures, which are the gold standard for internal/external security threats. This solution is used by leading custodians, crypto banks, and Multi-Party Computation solutions.

Yes, you can stake ETH with Ledger (via native connection) or Trezor (via metamask)

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

No, your ETH is locked in the Ethereum smart-contract.

P2P takes its service fee from the execution layer rewards. By default a special immutable smart contract is used to automatically split rewards between user and P2P by previously agreed rules. Other invoicing strategies can be employed by prior agreement.

Unstaking will be available after Shanghai upgrade, which is planed for March 2023. The ustaking time is projected to be 2-3 days depending on the number of validators wanted to exit and this process consists of four steps:

There will be unstaking page, where you should autorize with your withrawal address and click unstake button.

P2P sends validator voluntary exit message to Ethereum network, and your validators get into the exit queue. Validator stops participation in block attestation and creation (and stops getting rewards and penalties). 16 validators per epoch (6.4 min) may exit. This is pretty quick, actually, now validators wait for 16-24h to enter, for instance (16 validators may enter each epoch); we may expect similar timings for the exit, but right after Shanghai, this queue may be much longer.

After exit validator waits 27 hours because the network wants to ensure you haven't been slashed.

Finally, you get into the second queue (the last one!). This time validator is totally deleted from the network and returns its ETH with consensus layer rewards. This queue capacity is the same as in the first one (16 validators per epoch)

1.

2.

3.

4.

Slashing punishes for actions that are very difficult to do accidentally, and it’s very likely a sign of malicious intent. It’s a really rare event: only 5 slashed validators within the whole network for the last month (or 0.001%). https://beaconcha.in/validators/slashings

What is “slashable” behavior? In a nutshell, it’s a violation of consensus rules in network. Now it’s a three conditions: proposal two conflicting blocks at the same time, double vote attestation and surround attestaton. It could be either a malicious specific action or misconfiguration (the most often it’s running two the same validators in network).

Slashing results in burning 1,0 ETH at once, and removing the validator from the network forever, which takes 36 days. During this time, the validator continues to work but can no longer participate in validation and block creation, getting a penalty of around 0.1 ETH in total.

Mostly, that’s all losses, but there is also an additional midpoint (Day 18) penalty that scales with the number of slashed validators, it’s called "correlation penalty”, which is currently theoretical, i.e., never encountered in mainnet, but we should understand it. This mechanism protects the network from large attacks. The math for calculation penalty is pretty complicated, but the summary is if there are only 1, 100, or even 1000 slashed validators within 36 days - it’s okay and penalty equals zero ETH. However, if the number of slashed validators increases to roughly 1.1% of all validators (currently 5.1k), this penalty becomes 1,0 ETH. And +1,0 ETH for every +1.1% slashed validators. So if 1/3 network is slashed, the penalty will nullify the whole stake (32 ETH).P2P takes its service fee from the execution layer rewards. By default a special immutable smart contract is used to automatically split rewards between user and P2P by previously agreed rules. Other invoicing strategies can be employed by prior agreement.

What is “slashable” behavior? In a nutshell, it’s a violation of consensus rules in network. Now it’s a three conditions: proposal two conflicting blocks at the same time, double vote attestation and surround attestaton. It could be either a malicious specific action or misconfiguration (the most often it’s running two the same validators in network).

Slashing results in burning 1,0 ETH at once, and removing the validator from the network forever, which takes 36 days. During this time, the validator continues to work but can no longer participate in validation and block creation, getting a penalty of around 0.1 ETH in total.

Mostly, that’s all losses, but there is also an additional midpoint (Day 18) penalty that scales with the number of slashed validators, it’s called "correlation penalty”, which is currently theoretical, i.e., never encountered in mainnet, but we should understand it. This mechanism protects the network from large attacks. The math for calculation penalty is pretty complicated, but the summary is if there are only 1, 100, or even 1000 slashed validators within 36 days - it’s okay and penalty equals zero ETH. However, if the number of slashed validators increases to roughly 1.1% of all validators (currently 5.1k), this penalty becomes 1,0 ETH. And +1,0 ETH for every +1.1% slashed validators. So if 1/3 network is slashed, the penalty will nullify the whole stake (32 ETH).P2P takes its service fee from the execution layer rewards. By default a special immutable smart contract is used to automatically split rewards between user and P2P by previously agreed rules. Other invoicing strategies can be employed by prior agreement.

There are a special mechanism in validators for preventing slashing conditions called slashing protection.This slashing protection is usually a database with a signing history, and the validator checks if the block can be signed. - in couple with monitoring and alerting it’s a default protection level. More. Additional protection levels depend on validator’s setup. P2P uses double-check with the separate database at the key-manager stage and secures validators key’s by Threshold (no single person, even a P2P engineer, can run a second validator, a quorum is required for that). And finally, institutional grade protection is slashing insurance, that seems the only way to be 100% protected.

P2P takes its service fee from the execution layer rewards. By default a special immutable smart contract is used to automatically split rewards between user and P2P by previously agreed rules. Other invoicing strategies can be employed by prior agreement.

If you stake with P2P you get your personal staking dashboard for tracking rewards and validator's performance (APR, staking balance, % of blocks created with MEV, attestation rate, missed block, comparison with the market etc.)P2P takes its service fee from the execution layer rewards. By default a special immutable smart contract is used to automatically split rewards between user and P2P by previously agreed rules. Other invoicing strategies can be employed by prior agreement.

P2P takes its service fee from the execution layer rewards. By default a special immutable smart contract is used to automatically split rewards between user and P2P by previously agreed rules. Other invoicing strategies can be employed by prior agreement.

P2P validators are downtime resistant because we have no single point of failure with back-ups of all critical infrastructure parts between 5 physical locations, including:

Signing infrastructure - 3 location-independent key managers with 2-of-3 threshold quorum for consensus (aka multi-sig)

Validator Node - we have reserve in a secure region ready to be activated within 1 min

Consensus layer nodes - our setup has top-3 consensus layer clients (Lighthouse, Prysm, Teku) at the same time for diversity and preventing outrages related to soft bugs in one client. It’s also increases availability for validator.

1.

2.

3.

P2P knows how to stake

Since 2017 P2P provides the best staking services.

Today, P2P serves hundreds of corporate and private clients from all over the world, providing everyone with a personalized and adaptable work environment on the 25 most valuable PoS networks.

Today, P2P serves hundreds of corporate and private clients from all over the world, providing everyone with a personalized and adaptable work environment on the 25 most valuable PoS networks.

Total staked assets

$1 097 922 017

Blockchain networks

25+

Globally distributed team of 150 employees and 75% engineers

Have questions? We will be glad to help

or use the contact form

Ask any questions in Telegram